Financial Services Wealth Management Case Study

Key Challenges

The private banking and wealth management sector is under constant pressure to update customer experiences. Getting used to modern technology. Wealth management must adapt to the growing needs of digital consumers as a result of RPA in order to stay competitive and current. Automating the onboarding process is necessary for a safe, efficient experience that reduces manual errors and increases compliance. The majority of customers anticipate simple, user-friendly procedures that improve their quality of life. By opening up the organization’s banking core systems, it will be possible to provide a more individualized financial ecosystem for customers and match their expectations.

Business Initiatives

MuleSoft RPA – Solution Approach Wealth Management

Accelerate delivery with end-to-end automation for every team:

Asset Allocation Robotic process automation, both basic and sophisticated, can eliminate manual labour and procedures on a large scale. Easily record and immediately automate business processes. Point-and-click tools allow you to accomplish this using a user interface, document, or image. Enable seamless collaboration and dismantling of silos between IT and business teams throughout the whole automation process.

MuleSoft RPA achieves end-to-end automation at scale and provides intelligent automation anywhere. It is seamlessly integrated with Anypoint Platform and Composer. Maximize output with quantifiable return on investment.

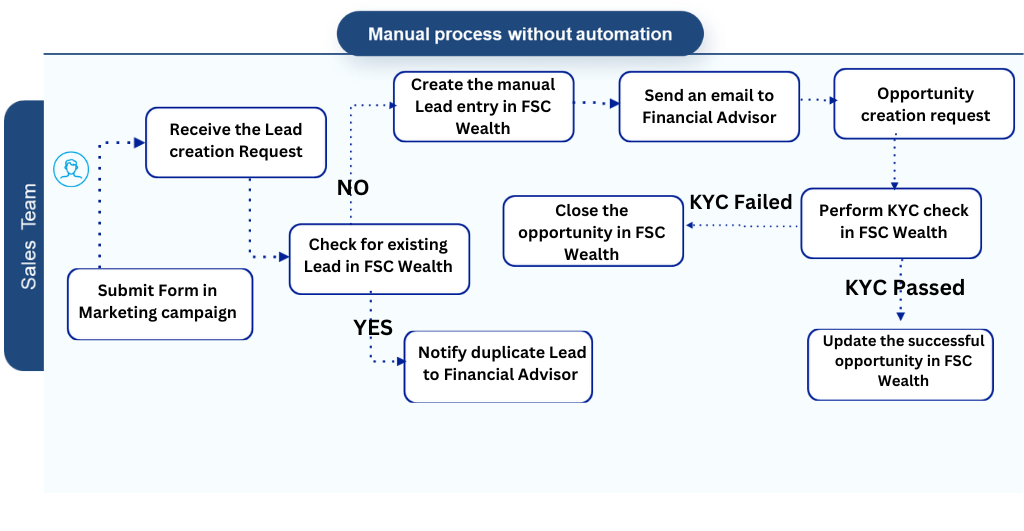

The Close opportunity in Salesforce and the Use Case Manual Lead Creation Client of FSC Wealth reacts in a marketing campaign.

Customer Story Quickly Boosts Lead Creation and close the opportunity (Sales Operations) With Just Clicks, Not Code.

Challenges

- Asset Allocation causing significant delays in Wealth Management’s customer onboarding procedure.

- The production of leads by hand is prone to human error.

Solution

- Wealth Management Built RPA Bots to extract the Lead from Marketing campaign submitted forms.

- RPA Bots checks for any existing Lead by using composer via RPA connector.

- Composer uses Salesforce connectors to update/close the Lead and perform KYC in FSC wealth management using an out-of-box connector.

- Composer notifies finance/sales teams for automated Lead and opportunity creation.

Results

- Wealth Management Automated sales manual task with greater compliance.

- Faster Lead conversion to client opportunity with less onboarding time.

- Highly productive responds to digital consumer demands.

- Improved client and financial advisor experiences in more real time.

Why MuleSoft? in Wealth Management

The only integrated platform for automation, APIs, and integration is MuleSoft.

MuleSoft Automation makes it possible for any team within a customer organization to automate, improving both the customer and staff experience.

MuleSoft RPA is designed with every team in mind. It streamlines manual, repetitive tasks and processes so that teams can innovate more quickly and easily. End-to-end automation is made possible by MuleSoft RPA, which is seamlessly connected with Salesforce Clouds, Composer, and Anypoint Platform to enable intelligent automation anywhere.

Realize value more quickly throughout the whole company by using clicks rather than code. Give IT and business teams the tools they need to work together on a reliable, safe platform. Quicken innovation in a safe and dependable manner.

Approach to RPA in Wealth Management

- In order to attain optimal process efficiency within the shortest duration, we assist organizations in implementing and scaling RPA programs. Attain this by using our tried-and-true RPA framework, a robotics center of excellence, and a committed staff of RPA specialists.

- We combine robotic process automation with API-led integration. Through a thorough comprehension of the customer’s advantages and disadvantages, enterprises can strategically implement both technologies.

- Our one-day API & RPA trial session covers building Automation Anywhere bots, experimenting with the current API-RPA connectors, and how bots can benefit APIs and vice versa.

- We actively support the company in closing the automation gap, safely opening more systems, and building complex integrations.

- We increase productivity with quantifiable return on investment by automating repetitive operations quickly and scalable across client businesses, saving time on both big and small tasks.

Why Change? Why Now? in Wealth Management

Automations are becoming critical to innovation.

In reaction to the pandemic, 69% of boards report accelerating digital business activities (The 2021 CIO Agenda, Gartner research). Seventy percent of executives in Europe said that they would probably speed up their digital transformation right now. IT now plays a critical role in the survival and expansion of businesses due to the pressing need to maximize operational efficiency, strengthen supply chain resilience, and satisfy customers’ digital needs. Business units favored RPA because it promised faster results and required less technical “no-coding” expertise from computer professionals.

Robotic Process Automation reaches its “Slope of Enlightenment” because new applications of RPA working with other technologies, such as APIs, are becoming more and more common.

Customer Point Of View – Compelling Reason to Act

In the 2021-22 financial year, the Wealth Management Private Bank reported net revenues of $5.7 billion. And this figure represented to the notable decrese compared to the previous year’s $6.8 billion in the resulting on a loss of $1.1 billion. This financial data highlights a significant shift in the bank’s financial performance from the previous year. Private Bank – Wealth management onboarding manual process takes to 1-2 weeks (Lead creation and close an opportunity) and loosing the potential client lead

Legal departments and financial advisors must prioritize freeing up their time from routine, repetitive, rule-based, and predictable tasks to focus on higher-value activities. The future success of Wealth management will likely depend on their ability to use the crisis to accelerate their digital transformation through Robotic Automation Process.

Due to COVID-19, it has significantly changed the way we work and live This transformation further drive technology-enabled solutions within the industry.

Customer Point Of View – Compelling Reason to Act

The Wealth Management Private Bank reported $5.7 billion in net revenues for the fiscal year 2021–2022. And this amount indicated a significant decrease from $6.8 billion the year before, translating into a $1.1 billion loss. The bank’s financial performance has changed significantly from the prior year, as seen by these financial figures. The manual onboarding procedure for Wealth Management at Private Banks can take up to 1-2 weeks, resulting in the loss of potential customer leads between lead creation and opportunity closure.

Financial advisers and legal departments need to make it a priority to free up time from predictable, rote, rule-based, and routine duties so they can concentrate on higher-value work. Wealth management’s capacity to leverage the crisis to speed up their digital transformation through robotic automation processes will probably determine how successful they are in the future.

The way we work and live has drastically changed as a result of COVID-19. Technology-enabled solutions are being driven farther within the sector by this transition.

Summary – Customer Satisfaction

Next Steps & Actions – Talk to the customer

Gaining access to the fundamentals of banking and automating a 360-degree picture of the financial data of customers. Modernizing payments with MuleSoft RPA. Enable the Discovery, Foundation, Design, and Outcomes components of the RPA Framework.

The Center for Enablement (C4E) has a communication plan, training and onboarding procedures, and roles that are well defined. The precise set of guidelines and precepts to follow when providing services is known as governance.

Roadmap: a detailed plan outlining how the company will provide user-centric services. A comprehensive scaling plan is necessary to guarantee that customers maximize the benefits of the RPA program.